Protecting your business in a high interest rate environment

“Have interest rates peaked? The answer is a resounding no.”

These were the words of Reserve Bank Governor Lesetja Kganyago in July 2023. The bank cautioned that the longer-term outlook remained uncertain amid the electricity and logistical issues, as well as the pressure on food prices. All these factors pose a risk to inflation and spending. This in turn affects our businesses.

“Have interest rates peaked? The answer is a resounding no.”

These were the words of Reserve Bank Governor Lesetja Kganyago in July 2023. The bank cautioned that the longer-term outlook remained uncertain amid the electricity and logistical issues, as well as the pressure on food prices. All these factors pose a risk to inflation and spending. This in turn affects our businesses.

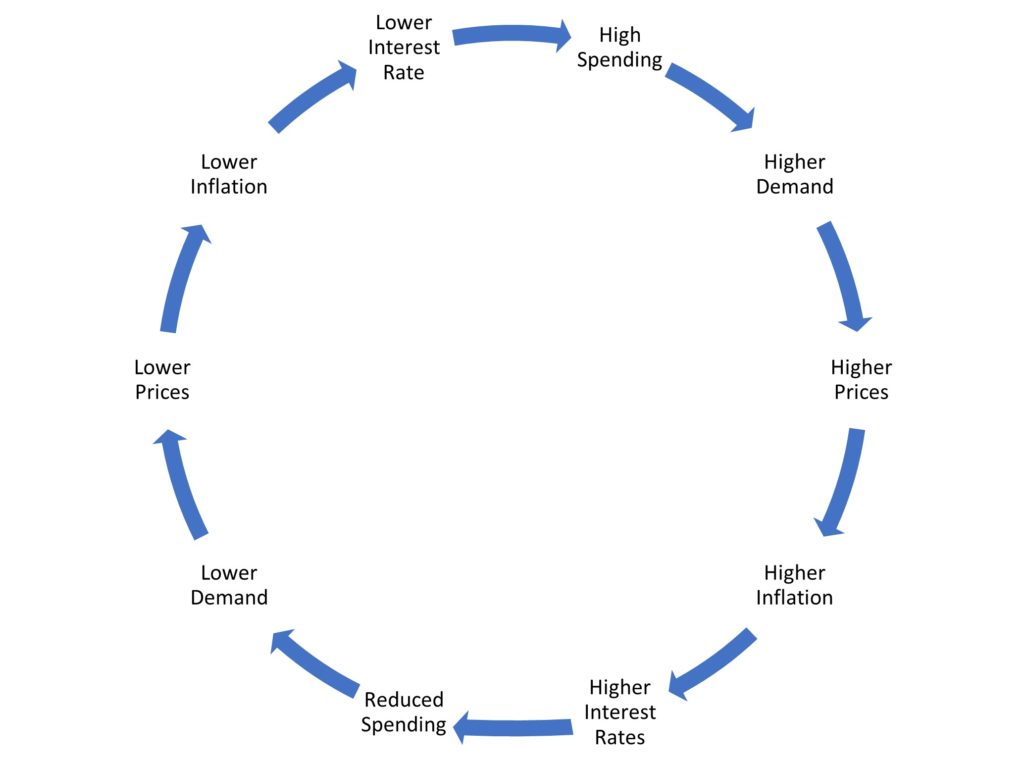

Interest rates affect the inflation rate and the spending of consumers

Look at the relationship between interest rates, inflation, and spending. As the price of goods and services rises over time, people lose buying power. To counteract the rising prices of goods and services the reserve bank raises the interest rate. The higher interest rates mean higher borrowing costs resulting in consumers spending less. Because consumers spend less the demand for goods and services will drop thus causing inflation to fall. The lower the interest rate the more consumers are willing to borrow money to make big purchases and the consumers have more money to spend. When businesses invest in machinery and infrastructure when interest rates are low it affects the economy positively. With higher interest rates consumers cut back on spending, and less investment in machinery and infrastructure resulting in slower productivity and retrenchments.

The management of interest rates is a balancing act between inflation and consumer spending.

We as business owners are not in control of this process although we are affected by it.

How to protect our businesses against the rise in the interest rate

The first step is to do an impact assessment on your business as the impact of the change in interest rates on consumers varies from business to business.

Consumers spend less on luxury items when their disposable income decreases. What will the impact be on your cash flow? Will the availability of disposable cash reduce sales? Loan repayments become more expensive (higher interest rate resulting in higher repayments).

Obtaining a loan is more difficult and more expensive. Not having access to credit can impact business growth negatively.

How will the reduced sales, constrained cash flow and the cost and difficulty of obtaining credit impact your business planning?

12 things to do to protect your business

- Consider how your business can offer more value for money.

- Factor in the effect of a higher interest rate on the budget and cash flow planning.

- The cash flow will also assist in deciding to apply for credit before it is too difficult and expensive.

- Assess the impact of the higher interest rate on your current loans to determine the affordability of the loans. This will enable you to act sooner rather than later. Actions that can be considered are:

- Consider consolidating or refinancing your debt while the interest rates are still low.

- Consider changing to or applying for a fixed interest rate. Variable interest rate loans will result in higher repayments which directly impacts the cash flow.

- Traditional loans were the norm, consider alternative financing options such as invoice factoring, merchant cash advances, and sell and buyback. Look for the solution that will be the best solution for your business.

- Sell some of your shares to raise additional capital. Whilst no additional finance cost is applicable, your ownership will be diluted. The dynamics of the dilution of ownership is a discussion on its own and may not be the best option for you, although the cheapest.

- Sell unused assets.

- Re-evaluate the impact of the interest rate on the viability of planned projects.

- Review your expenses if you have not done so yet.

- Optimise your finances by getting your debt and expenses under control and may take a smaller salary to increase the cash flow of the business.

Whilst some businesses will benefit from the rise in the interest rate, others may take a significant hit. As a business owner, you must understand how the interest rate could impact your business and be aware of your options. The business that succeeds is the one that prepares!