National

Do you have a business or a job?

“Many businesses are ultimately shuttered rather than sold, often at the expense of the business owner and their family. This is largely because most businesses are not initially structured for sale; rather, they are crafted to sustain a particular lifestyle.” – Pavlo Phitidis

WHAT CAN TRADERS EXPECT IN 2024?

The tech terrain experienced a riveting 2023, propelled by AI innovations and the essential hardware supporting them. However, with concerns looming from war, logistical challenges, high interest rates, and the persistent remnants of the Covid-19 pandemic, the question on traders’ minds is: What does 2024 hold?

‘LUKAS’ TO MAKE HISTORY AS THE FIRST NAMIBIAN FILM TO SCREEN IN CINEMAS IN SOUTH AFRICA

Following its successful premiere at Ster Kinekor Grove Mall on 01 February 2024 ‘Lukas’, the Ombetja Yehinga Organisation (OYO) latest film, will make history as being the first Namibian film to screen in cinemas in both Namibia (Ster Kinekor Grove Mall and Maerua Mall) and South Africa (Johannesburg (Ster Kinekor Rosebank Nouveau and Southgate) and Cape Town (V&A Waterfront and N1 City)) from 08 March 2024.

Editor’s Note

The digital world is always changing, and we need to keep up with it, especially if we’re starting a business, even more so if we’re older. This means we must learn new things all the time to stay on top of what’s happening.

CMTrading launches PAMM+

2024 launches with good news for those fund managers licensed in South Africa looking to easily invest on behalf of clients in forex or global markets who want to maximise their benefits. CMTrading has announced the launch of its PAMM+ platform, an intuitive and easy way to invest with experienced trader support.

Excessive Gaming and Its Toll on Children’s Futures

In the age of digital connectivity, the allure of online gaming has captivated millions of children worldwide. While gaming can offer entertainment, socialization, and even cognitive benefits when enjoyed in moderation, the line between healthy engagement and excessive indulgence is often blurred. What’s more concerning is the role of parental permissiveness in enabling and even exacerbating this phenomenon.

HBC MEMBER PROFILE

How did you start your business?

Riane, my mother and the owner of The Stationery Studio, brings over 40 years of experience in the stationery industry. She’s worked with major distributors like Bidvest, handling brands like Parker, Waterman, Sharpie, HP, Samsung, and Pantum. She’s soaked up all that expertise to pass it on to our own business.

As for me, stationery is my world. I’ve been around it since I was 5 years old, helping customers in our store and serving them at the counter like it’s second nature.

Why did you choose your industry?

Back in 2004, Hartbeespoort was a small community with just the basics in terms of stores. Around that time, we decided to open our own stationery shop. Interestingly, this was when the first “mall,” Sediba Plaza, was being built. Being part of this development allowed us to be the first stationery and art store in a big shopping area.

Starting a business involves taking a chance, but it’s important to be smart about it. With the new mall on the horizon, and knowing it would house reputable businesses, it seemed like the right move to start ours there. Success in business often relies on meeting demand. Since there were no other stationery shops in town, it was a no-brainer for us. Everyone needs stationery, whether it’s a hairdresser, student, or professional, though they may not need the same amount.

What makes your business different from your competitors?

I’ve always believed in leading the way in my industry, not just following others. To stand out, you have to offer something unique compared to your competitors. Tom Abbott sums this up well: “It’s not just about being better. It’s about being different. You need to give consumers a reason to choose your business.”

Stationery is everywhere these days, from grocery stores to clothing shops. While the quality might not match what we offer, it’s still stationery. So, I asked myself, “Yes, we sell stationery and art supplies, but what sets us apart?” That’s when the idea of gifting came to mind. But what kind of gifting? Would a few patterned mugs and hand-knitted handbags really make us stand out? Then, I had a breakthrough! I decided to collaborate with bespoke gifting brands like CaRRoL BoYeS, Yankee Candle, WoodWick, Jenna Clifford, and Anke Products. And just like that, we were different.

It’s important to be aware of your competitors, but don’t let it consume you. As the saying goes, “A flower does not compare itself to the other flower beside it, it simply grows.” Focus on your own growth as a business. Trust yourself and your uniqueness, and you’ll thrive. No need to look back or compare—just keep moving forward.

What are your biggest challenges in your industry?

As a large retail store, you can count on many products to sell and keep your stock moving. But retail also involves taking risks by introducing new items into your store, hoping they’ll be a hit. Every time you bring something new in, you’re essentially betting that people will love it and buy it. However, I’ve learned that not every product I’m excited about will sell as well as I hoped.

In business, we learn a lot of lessons, but it’s also important to unlearn some habits. Whether it’s the fear of new competition, a slow day, or delays in stock arrival, we need to unlearn the tendency to react with anxiety and fear. I often remind myself and my team, “We’ve got this!” This helps us stay calm and confident, knowing we can handle whatever comes our way without always reacting as we might instinctively do. Unlearning can be challenging, but it’s a challenge we tackle every day.

What advice will you give people in the same work industry as you?

Becoming too comfortable is risky in any industry. If you rely solely on a franchise or having a large inventory, you’re navigating dangerous waters. With the rise of e-commerce, consumers can easily buy what you offer with just a click. You need to constantly remind them why supporting your business is better than online shopping. Simply coasting on past success without setting new goals is just as risky. Studies show that it takes several purchases to build brand loyalty. So, every customer interaction matters, regardless of how much they spend. Some of our most loyal customers started with small purchases.

Believe in your team. It’s not about “me,” it’s about “we.” Together, we can succeed. High employee turnover is a red flag, as it makes implementing new ideas difficult. I believe in servant leadership—there’s no hierarchy in our store. I’m willing to get my hands dirty alongside my coworkers. Investing in your team is crucial. It’s not just about paying them; it’s about creating a positive work environment. Rather than singling out one employee, celebrate all achievements, big or small. This keeps everyone motivated and appreciated.

Visibility equals credibility equals profitability. Even if marketing feels like a time sink, remember that even huge companies like Coca-Cola advertise. If you’re not visible, you’re forgotten. Engage with local businesses and events to build relationships and stay top-of-mind with customers.

A Journey from Conventional Cleaning to Sustainable Impact

Isitsha Environmental Africa, founded three years ago, initially ventured into the decontamination cleaning space armed with cutting-edge technology. However, as we progressed, a stark realization dawned upon us: our existing approach was prohibitively expensive for our clients. Despite our best efforts, we were merely addressing short-term cleanliness. The true challenge lay in safeguarding the environment, homes, and businesses against persistent pathogens.

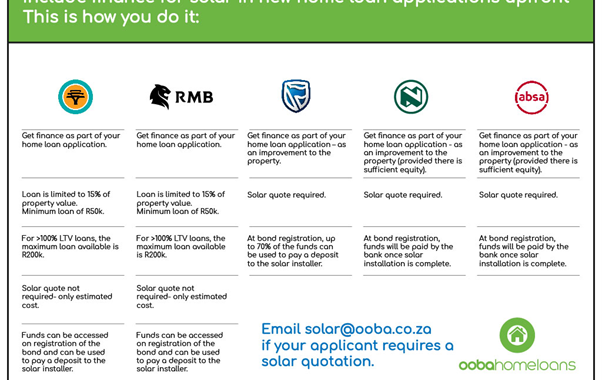

The Bright Future of Harnessing Solar Power

Written collaboratively by: Kevin Mountjoy {Ooba Cradle} & Tenique Naudé {Pam Golding Properties Hartbeespoort}. Amid

The Bright Future of Harnessing Solar Power

Amid rising electricity tariffs and unprecedented loadshedding in 2023, homeowners are turning their gaze toward the sun for energy solutions. Solar power has rapidly transformed into a beacon of hope for many homeowners seeking sustainability, savings in electricity costs, and a brighter future for their homes. Picture your home, bathed in the gentle glow of the sun, powering itself while reducing your carbon footprint.

Naspers Labs-backed SA Harvest Programme Empowers Youth with Agriculture Skills

Lusikisiki, Eastern Cape, South Africa – Ten post-graduate students who were previously unemployed recently embarked on a remarkable journey from Lusikisiki, Eastern Cape, to Tzaneen, Limpopo Province, as part of the SA Harvest entrepreneurial incubator initiative. Supported by Naspers Labs, this programme aims to equip young individuals with the skills and knowledge needed to become self-sufficient agri-food entrepreneurs.

Top tips for naming brands

From time to time in my work as a brand consultant, I take part in naming projects. Naming can be like buses – you wait for ages for one to come, then two come at once. 2023 has been a year for naming things.

Unmasking Neglected Realities: Exploring the Overlooked Dimensions of Agricultural Crime

Livestock theft is wreaking havoc on the South African economy, causing an estimated annual loss of 1.4 billion. The situation is rapidly deteriorating, with farmers living in constant fear for their lives and witnessing the brutal and savage on-site slaughtering of their cattle. The repercussions are dire, not only for individual farmers but also for the broader agricultural landscape in South Africa.