Will something bad happen or not?

Risk is simply defined as a future uncertainty about the probability and severity of something happening. It is important that we identify these risks to enable us to manage them and achieve the objectives of the business. In essence risk management is all about planning.

The 4 main types of risk are:

- Strategic risk – e.g. you own a speciality store and a chain store opens a branch in your area

- Compliance and regulatory risk – e.g. the introduction of minimum wage

- Operational risk – e.g. theft of key equipment

- Financial risk – e.g. interest rate hikes

But other risks can also be a threat to your business. These include environmental risks, political and economic instability, health and safety risks, work force risks and risks pertaining to your specific industry or business model.

Financial risk will be the focus of this article.

Business owners must understand their finances and must be prepared for all eventualities.

The first category of financial risks is market risks, it is the possible loss due to changes in market prices like the rise of interest rates and commodity prices due to a rise in inflation; for importers the rise in the exchange rate. The second category is the risks pertaining to your customers, suppliers, or partners. For example, if your business income is mainly derived from one customer or you source products from only one specific supplier. Financial risk could also come about if your business partner, or any major stakeholder, suddenly does not qualify for much needed credit to continue operating. The last category is financing or liquidity risk. This is the ability to obtain financing. Or the risk that the business will not be able to service their debt when it falls due. The cash flow is a risk to be managed by itself, as it is the life blood of any business.

The most important benefit of managing the financial risk in a business is the ability to focus on the core activities and to achieve the business goals. Then the business will be seen as successful and you as competent and credible. It will remove the volatility in earnings and ensure stability. The cash flow will be protected. All this will increase the possibility to obtain finance, thus the business will be in a better position to exploit opportunities.

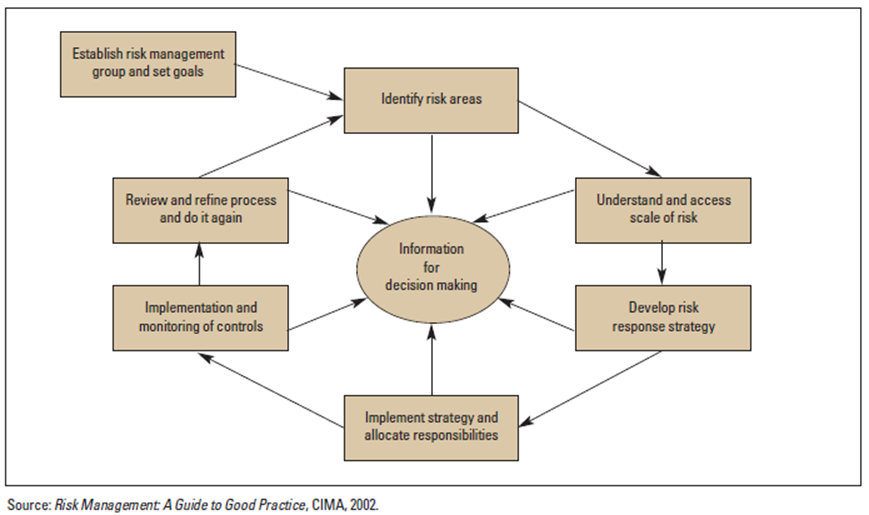

Risk can be managed in a framework.

The starting point is to identify the risks that are a threat to the business goals. As an entrepreneur this can be difficult on your own. Brainstorm, talk to others and analyse your business goals to identify the threats.

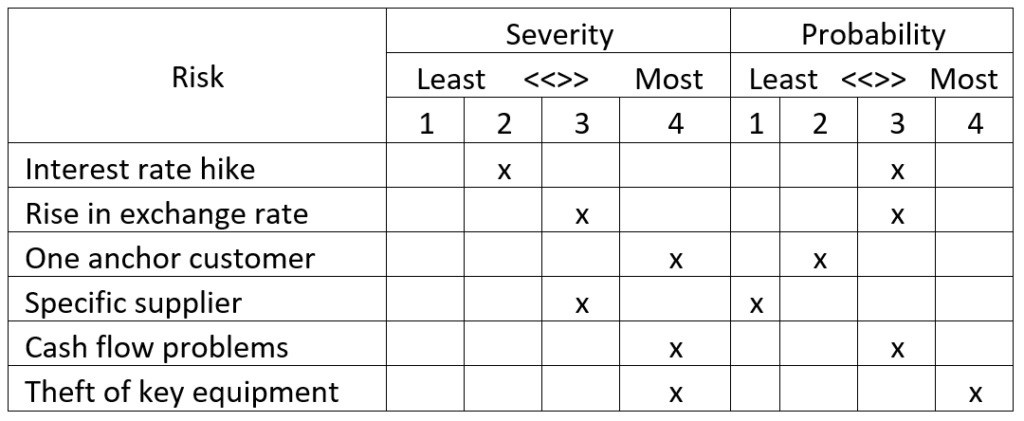

Rate these risks on a scale of probability and severity.

Rate the probability of the risk in terms of:

- Almost certain to happen, or happens very frequently

- More likely to happen, than not to happen, or happens often

- Could happen or happens frequently

- Unlikely to happen, or almost never happens

Rate the severity according to:

- Financially devastating, possibly resulting in bankruptcy

- A huge financial impact that would result in radical change

- An uncomfortable but manageable financial impact

- Very little financial impact

You can use the table format to start the process:

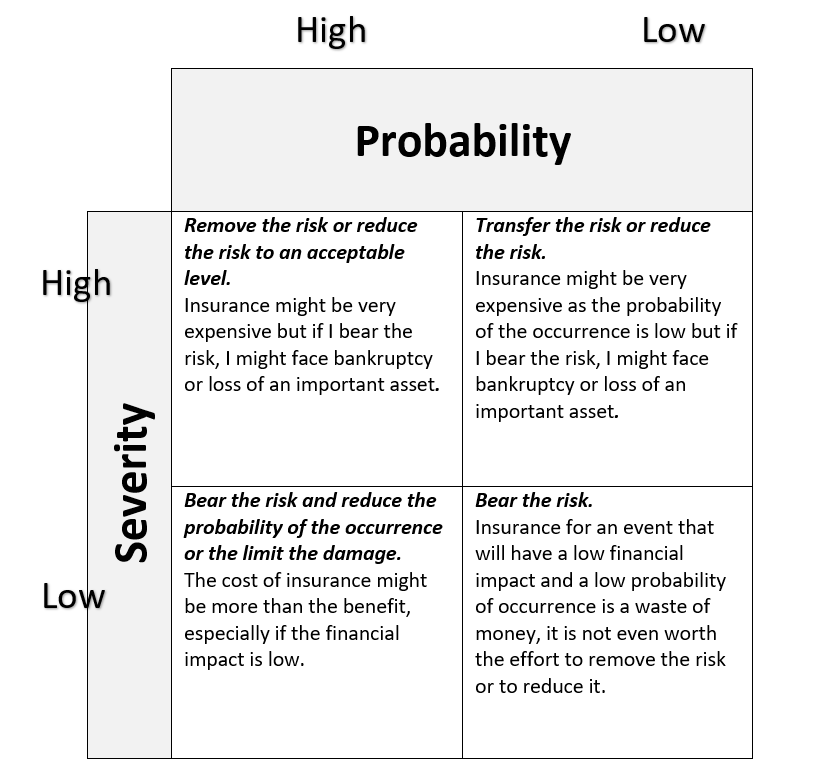

After the risks have been identified and evaluated, controls must be put in place. The risks can be controlled by bearing the risk, transferring the risk, reduce the risk and to remove the risk and the methods of how the risk will be controlled must be implemented. The controls must be monitored, reviewed, and refined. See table below as an example for a possible method to control the risk.

Managing risk is a continuous process.

Every business faces financial risks and the ability to manage those risks will determine the achievement of the goals and even the ability to thrive.

You will definitely not get a clear-cut answer to whether something bad will happen or not, but you will be able to remove some uncertainty. Not managing the risk is most certainly more expensive than not making the effort. The good news is that a large body of knowledge on the risk management process is readily available so that companies can adopt a process view that best fits their circumstances.